The Total Guide to Sending an Online Tax Return in Australia in 2024

The Total Guide to Sending an Online Tax Return in Australia in 2024

Blog Article

Navigate Your Online Income Tax Return in Australia: Vital Resources and Tips

Navigating the online tax return procedure in Australia requires a clear understanding of your obligations and the resources available to improve the experience. Important files, such as your Tax File Number and income declarations, need to be meticulously prepared. Picking a proper online platform can dramatically impact the efficiency of your declaring process. As you think about these aspects, it is vital to likewise understand typical risks that numerous experience. Recognizing these subtleties can eventually save you time and lower stress and anxiety-- leading to an extra positive outcome. What approaches can best aid in this undertaking?

Understanding Tax Obligation Obligations

People need to report their income precisely, which includes salaries, rental earnings, and financial investment incomes, and pay tax obligations as necessary. Homeowners must recognize the difference between non-taxable and taxable earnings to make certain compliance and optimize tax obligation results.

For companies, tax obligations include several facets, including the Item and Solutions Tax (GST), company tax obligation, and pay-roll tax. It is important for services to register for an Australian Organization Number (ABN) and, if relevant, GST enrollment. These responsibilities demand meticulous record-keeping and prompt submissions of tax returns.

In addition, taxpayers must recognize with readily available deductions and offsets that can relieve their tax obligation concern. Inquiring from tax obligation professionals can give useful understandings right into optimizing tax obligation positions while making certain conformity with the law. Generally, an extensive understanding of tax obligation obligations is vital for efficient monetary preparation and to prevent charges related to non-compliance in Australia.

Necessary Documents to Prepare

Additionally, compile any type of pertinent financial institution declarations that reflect interest earnings, in addition to returns declarations if you hold shares. If you have various other incomes, such as rental buildings or freelance work, guarantee you have documents of these profits and any type of connected costs.

Don't forget to include deductions for which you may be eligible. This might entail receipts for work-related expenditures, education and learning prices, or philanthropic contributions. Finally, consider any type of exclusive medical insurance declarations, as these can impact your tax obligation commitments. By collecting these necessary papers ahead of time, you will streamline your on-line income tax return procedure, decrease errors, and optimize possible reimbursements.

Selecting the Right Online System

As you prepare to submit your online income tax return in Australia, choosing the appropriate platform is necessary to make certain precision and convenience of use. A number of key aspects ought to guide your decision-making process. Initially, consider the system's interface. A simple, instinctive layout can dramatically improve your experience, making it simpler to navigate complex try this site tax obligation kinds.

Next, assess the platform's compatibility with your monetary circumstance. Some services cater specifically to individuals with simple income tax return, while others provide extensive support for a lot more intricate scenarios, such as self-employment or investment earnings. Look for platforms that supply real-time mistake monitoring and support, aiding to minimize errors and guaranteeing compliance with Australian tax regulations.

One more crucial element to think about is the level of customer assistance offered. Trusted systems should give accessibility to support using phone, e-mail, or conversation, specifically throughout top declaring durations. Furthermore, research study individual reviews and rankings to assess the overall fulfillment and dependability of the platform.

Tips for a Smooth Declaring Refine

Filing your on-line tax obligation return can be a straightforward process if you comply with a few crucial suggestions to make sure performance and precision. This includes your earnings declarations, invoices for reductions, and any type of various other pertinent paperwork.

Next, take benefit of the pre-filling attribute provided by lots of on-line platforms. This can conserve time and lower the chance of mistakes by immediately populating your return with details from previous years and information offered by your company and economic organizations.

Additionally, confirm all entrances for accuracy. online tax return in Australia. Errors can lead to delayed reimbursements or problems with the Australian Tax Office (ATO) Ensure that your personal information, income figures, and reductions are proper

Bear in mind due dates. Filing early not only reduces anxiety yet additionally permits far better preparation if you owe tax obligations. Finally, if you have inquiries or uncertainties, speak with the assistance areas of your selected platform or look for specialist recommendations. By following these suggestions, you can navigate the on-line tax obligation return process efficiently and with confidence.

Resources for Aid and Support

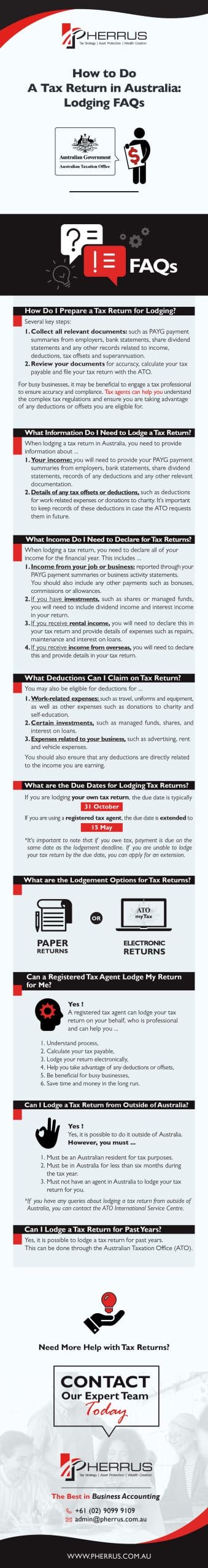

Navigating the intricacies of online tax obligation returns can occasionally be challenging, but a range of sources for aid and support are conveniently available to aid taxpayers. The Australian Taxation Workplace (ATO) is the primary resource of information, supplying extensive overviews on its site, consisting of FAQs, educational video clips, and live chat alternatives for real-time support.

In Addition, the ATO's phone support line is available for those that prefer direct interaction. online tax return in Australia. Tax specialists, such as authorized tax obligation representatives, can also supply customized advice and guarantee compliance with existing tax obligation laws

Conclusion

In final thought, efficiently navigating the on the internet income tax return process in Australia needs a thorough understanding of these details tax responsibilities, careful prep work of crucial records, and mindful choice of a proper online system. Abiding by useful suggestions can improve the filing experience, while available resources offer important help. By coming close to the process with diligence and attention to information, taxpayers can ensure compliance and optimize prospective benefits, ultimately adding to a much more efficient and successful tax return result.

As you prepare to file your online tax return in Australia, selecting the Full Article ideal platform is vital to make certain accuracy and convenience of use.In verdict, successfully browsing the on-line tax obligation return process in Australia calls for a complete understanding of tax obligation obligations, precise prep work of vital documents, and cautious option of a suitable online system.

Report this page